“Depression-Like Crisis” Unfolding With No V-Shaped Recovery Until 2023, UCLA Anderson Warns

by Tyler Durden

ZeroHedge.com

Thu, 06/25/2020

At a time when the Trump administration continually promotes a V-shaped economic recovery from the coronavirus pandemic, a new UCLA Anderson Forecast has revised its economic forecast down, with no recovery this year or next.

UCLA Anderson Forecast senior economist David Shulman writes in its second quarterly forecast of 2020, that the virus pandemic has “morphed into a Depression-like crisis” with no V-shaped recovery until 2023.

“To call this crisis a recession is a misnomer. We are forecasting a 42% annual rate of decline in real GDP for the current quarter, followed by a ‘Nike swoosh’ recovery that won’t return the level of output to the prior fourth quarter of 2019 peak until early 2023,” Shulman writes in a report titled “The Post-COVID Economy.”

“On a fourth-quarter-to-fourth-quarter basis, real GDP will decline by 8.6% in 2020 and then increase by 5.3% and 4.9% in 2021 and 2022, respectively,” he notes.

Shulman says the labor market might not recover until “well past 2022,” and the unemployment rate will stay stubbornly high, well over 10% through the fourth quarter of 2020. A labor recovery might not be seen for several years.

“For too many workers, the recession will linger on well past the official end date,” he warns.

He says the economy is in desperate need of more stimulus via the Federal Reserve and the federal government to support ailing corporate bond markets and a severely damaged consumer.

“Simply put, despite the Paycheck Protection Program, too many small businesses will fail and millions of jobs in restaurants and personal service firms will disappear in the short run. We believe that even with the availability of a vaccine, it will take time for consumers to return to normal,” Shulman writes.

The report says the economy has hit bottom, that doesn’t necessarily mean GDP and employment levels will immediately surge back to fourth-quarter 2019 levels, as heavily indebted companies and weak consumers will lead to sluggish economic activity.

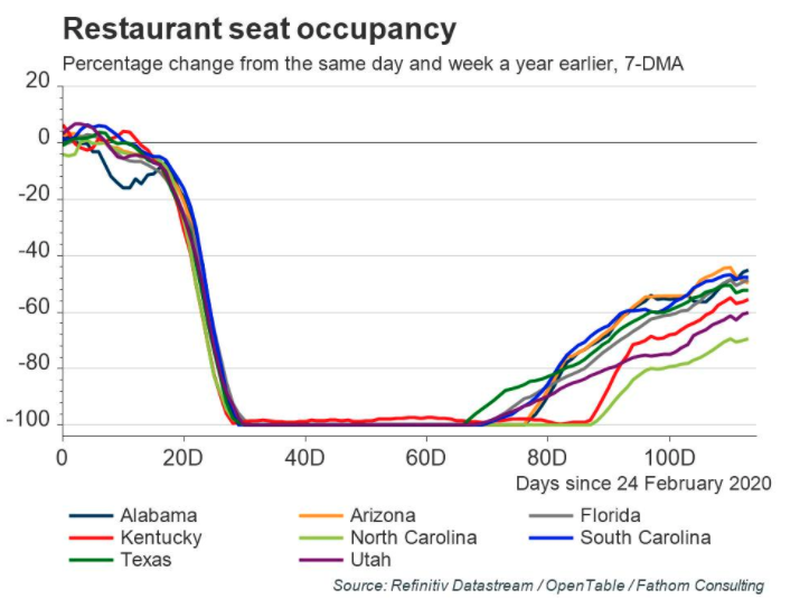

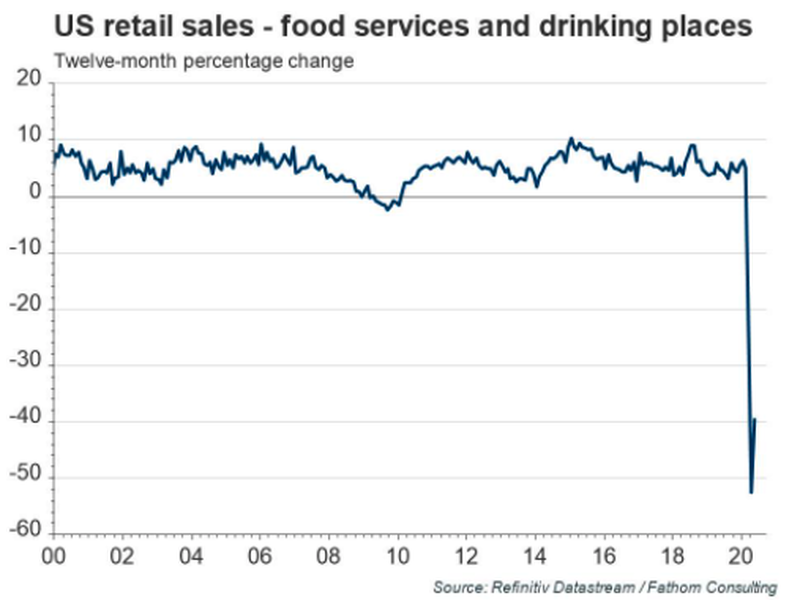

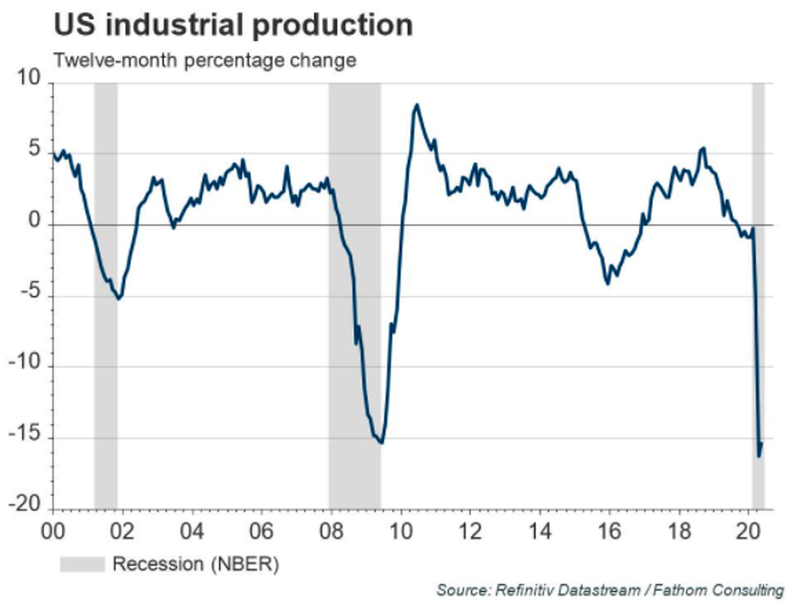

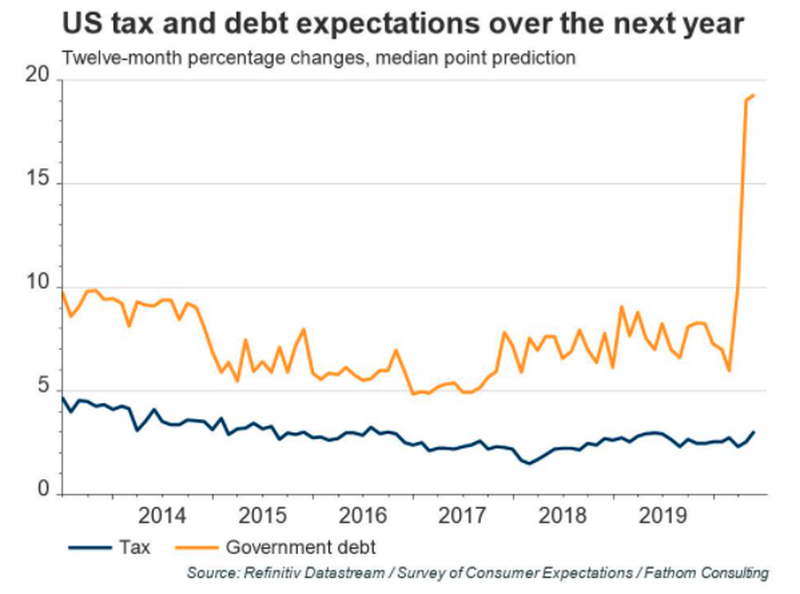

For more color on the recovery so far, Fathom Consulting offers a glimpse into a less than stellar rebound:

US retail sales for restaurants have yet to bounce significantly.

Industrial production remains at lows.

An explosion in government debt to prop up the crashed economy.

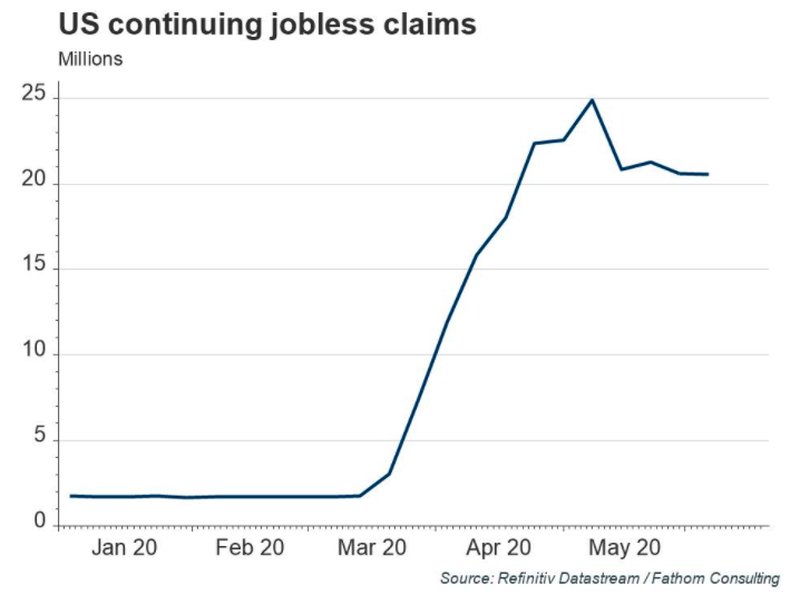

Tens of millions of people out of work.

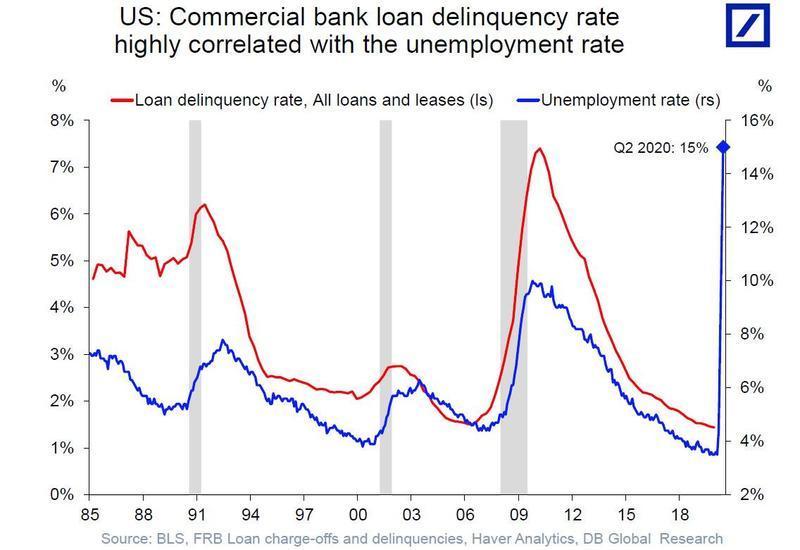

High unemployment suggests a “biblical” wave of bankruptcies is about to flood the US economy.

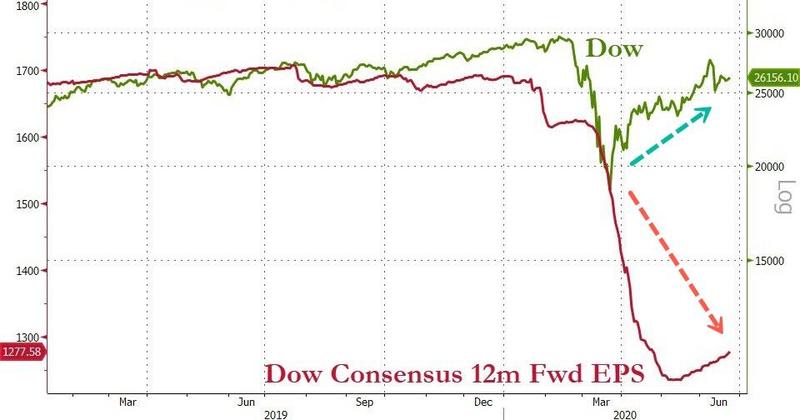

Meanwhile, the stock market’s disconnect from reality is setting up for the next possible stock market correction.

Corporate profits are sliding, stocks are rising. Alligator jaws…

UCLA Anderson Forecast’s new downward revision of the recovery suggests the worst has yet to be seen – several more years of pain are likely ahead.