Central Banks Bailed Out Markets To Avoid Trillions In Pension Losses

by Tyler Durden

ZeroHedge.com

Sat, 06/13/2020

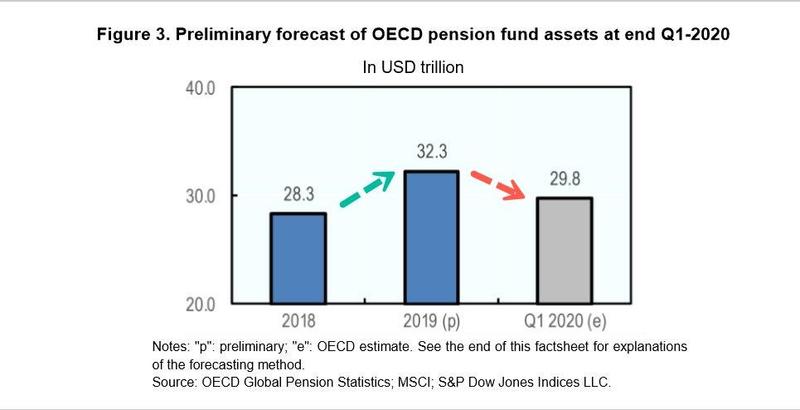

The Organization for Economic Co-operation and Development (OECD) recently published a report showing how pension funds in OECD countries recorded a massive loss of approximately $2.5 trillion during the stock market meltdown in February through late March. Shortly, after that, central banks intervened with monetary cannons to rescue stock markets and other financial assets to avoid pension returns from going negative.

The spread of COVID-19 worldwide and its knock-on effects on financial markets during the first quarter of 2020 are likely to have reversed some of these gains. Early estimates suggest that pension fund assets at the end of Q1 2020 could have dropped to USD 29.8 trillion, down 8% compared to end-2019 [or about a $2.5 trillion loss].

The drop in pension fund assets is forecast to stem from the decline in equity markets in the first quarter of 2020. Returns, inclusive of dividends and price appreciation, were negative on the MSCI World Index in the first quarter of 2020 (-20%), and between -11% and -24% on the MSCI Index for Australia, Canada, Japan, the Netherlands, Switzerland, the United Kingdom, the United States.

An increase in the price of government bonds that pension funds own could partly offset some of the losses that pension funds experienced on equity markets in Q1 2020. Some Central Banks, such as the Federal Reserve in the United States, cut interest rates in 2020 to support the economy. The fall in interest rates may lead to an increase in the price of government bonds in the portfolios of pension funds as the yields of newly issued bonds decline. – OECD

Bloomberg’s Lisa Abramowicz pointed out in a tweet, “this report [referring to the OECD report] shows the massiveness of pension assets & points to why central banks are tethered to bailing out markets: social infrastructures depend on their not going down too much.”

Abramowicz is 100% right. A significant drop in asset prices, if that is in equities, commodities, corporate bonds, etc., central bankers are quick to act by lowering interest rates and firing up the printing presses.

This was seen in March when the Federal Reserve and other major central banks unleashed monetary cannons to arrest volatility and hockey stick save asset prices.

The Rest…HERE