Morgan Stanley Publishes Full Timeline Of Upcoming Coronavirus Milestones; Sees Second Coronavirus Peak In December

by Tyler Durden

ZeroHedge.com

Mon, 04/13/2020

Now that it has become clear that every day that the US economic shutdown continues as a result of the coronavirus pandemic means billions in economic losses and untold damages to the social fabric of the United States where over 20 million people will soon be unemployed, what all analysts – and frankly everyone else – want to know is i) when will the US reach the peak of the coronavirus curve and ii) when will the US start reopening.

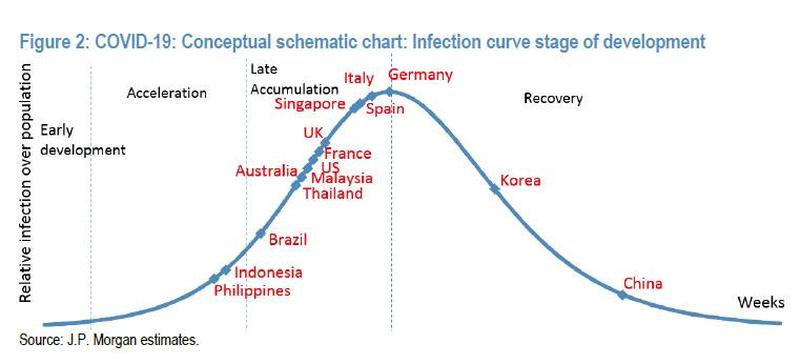

Addressing the first, we showed some good news yesterday when the latest JPMorgan coronavirus “curve” showed the US fast approaching the peak of the curve, i.e., the end of the “late accumulation” phase, and sliding into recovery.

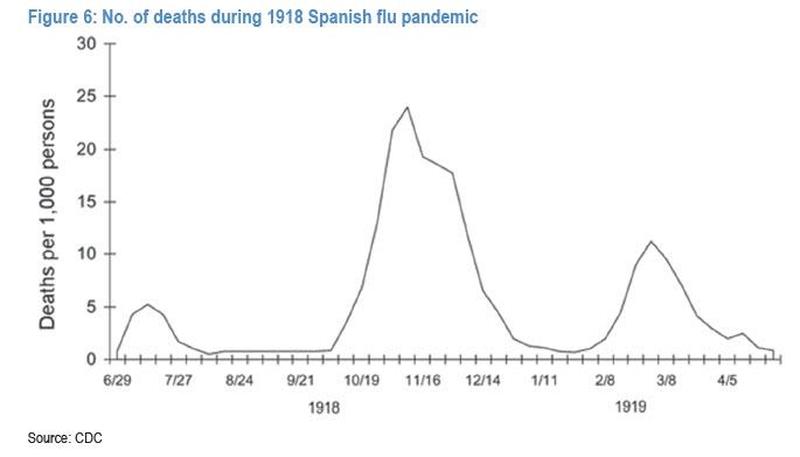

Yet while the first wave of the pandemic appears to be approaching its zenith, the big concern is that a second, even more powerful wave may emerge afterwards if the Spanish flu pandemic is any indication.

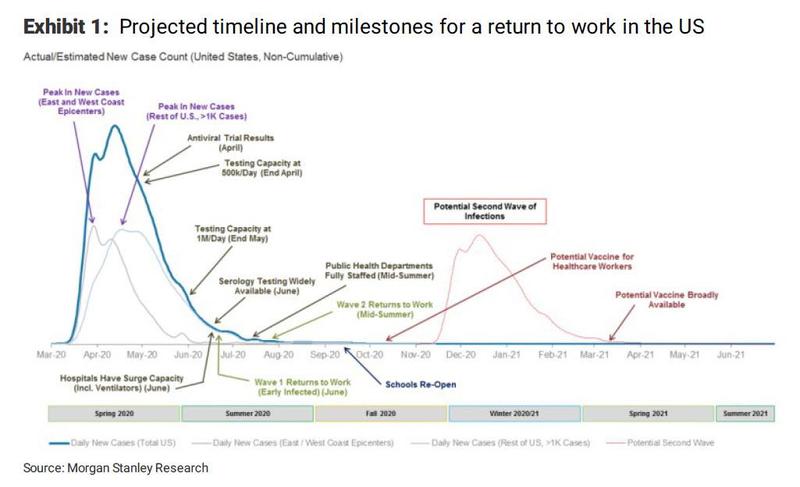

Unfortunately validating fears that the first wave is only the beginning, in a Sunday note from Morgan Stanley’s chief biotech analyst Matthew Harrison, he writes that “recovering from this acute period in the outbreak is just the beginning and not the end” and “the path to re-opening the economy is going to be long. It will require turning on and off various forms of social distancing and will only come to an end when vaccines are available, in the spring of 2021 at the earliest.”

Specifically, the biotech strategist expects a “multiphasic” peak in which coastal regions, led by New York, will peak “over the next 3-5 days. However, we expect the rest of the country to follow slowly, trailing the coasts by around three weeks.” And while this “second” peak is unlikely to be as severe as the first (~10,000-15,000 daily new cases versus 30,000-35,000 in the first peak), “it means the US outbreak will have a very long tail. This much longer tail would put the US time to peak at ~4x China and 2x Italy, driven by the slow uptake of social distancing measures and lack of robust testing. This would put an initial US reopening on track for mid-to-late May at the earliest.”

It gets worse, with the biotech analyst also predicting that there “will still be a large number of workers not able to go back to work until a vaccine is abundantly available as social distancing cannot be fully relaxed until we have herd immunity (~60% of people vaccinated). Furthermore, large venues such as sports stadiums, concert halls and theme parks are also likely to remain shut or have attendance capped at 10-25% of prior levels.”

Finally, and most ominous, Morgan Stanley warns that a potential second wave of infections could strike around November/December, which the bank hopes will be less severe than the current peak, although in truth nobody knows.

“This view on the delayed peak and slow return to work has led our US economists to revise their US forecast to a return to pre-COVID-19 levels not until 4Q21” Harrison writes, but concludes on a positive note, pointing out that there are promising antivirals and antibody therapies in the pipeline with data starting in April and continuing through the late summer.

We believe that at least some of these drugs can be successful and help to turn severe cases into milder forms of the disease. Such an outcome could reduce the potential strain on hospitals and allow public health officials to support a broader re-opening of the economy before a vaccine is available

One can only hope that he is right.

Below is the full timeline of upcoming key coronavirus milestones from Morgan Stanley: