Goldman Issues Shocking Warning On Systemic Threat From Supply-Chain Collapse

by Tyler Durden

ZeroHedge.com

Mon, 02/24/2020

Having desperately avoided any discussion of a worst-case coronavirus scenario – or frankly any scenario that did not involve all time highs for stocks – for over a month, suddenly the market is obsessing with what a complete paralysis of China could mean for the world, not just in terms of millions in small and business companies shuttering and the financial sector collapsing under the weight of trillions in bad loans, but specifically how global supply chain linkages would cripple commerce across the globe as corporations struggle to find economic alternatives if China’s economy indeed goes dark.

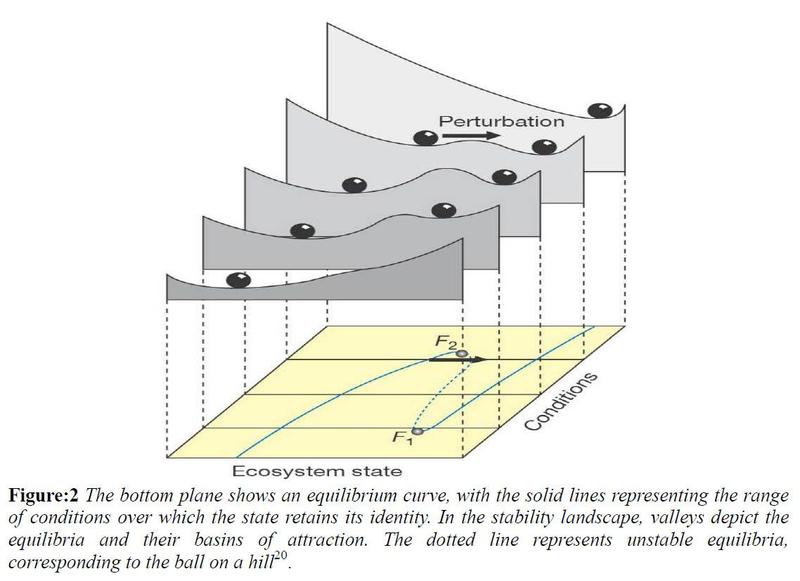

However, as long-time readers may recall, the problem with trying to model supply chains shocks, especially in today’s “Just In Time” world, is that this task is virtually impossible as such a simulation very quickly reaches impossible complexity, something we first described in 2012 in our article “A Study In Global Systemic Collapse”, which referred to the FEASTA article titled “‘Trade-Off: Financial System Supply-Chain Cross-Contagion” which showed that contagion within supply chains could quickly lead to wholesale, systemic collapse due to non-linear bifurcations between sequential phase states.

Not for nothing, this is how we described the study back in 2012: “think of the attached 78-page paper as Nassim Taleb meets Edward Lorenz meets Malcom Gladwell meets Arthur Tansley meets Herman Muller meets Werner Heisenberg meets Hyman Minsky meets William Butler Yeats, and the resultant group spends all night drinking absinthe and smoking opium, while engaging in illegal debauchery in the 5th sub-basement of the Moulin Rouge circa 1890.”

And while there was far more in the report, one section was notable – the one discussing how relentless central bank intervention has made the global system far more brittle, or as Taleb would call it, extremely not anti-fragile:

The final point is about black swans & brittle systems: The growing stress in our very complex globalised economy means it is much less resilient, see the discussion in section 3.1 and figure 2. Thus a small shock or an unpredictable event could set in train a chain of events that could push the globalised economy over a tipping point, and into a process of negative feedback and collapse.

The Rest…HERE