Fed Warns “Asset Valuations Elevated”, Coronavirus Presents “New Risk” To Global Outlook

by Tyler Durden

ZeroHedge.com

Fri, 02/07/2020

With the sellside piling in and rushing to outforecasting itself on how much global GDP growth will be hit in Q1 (and onward) as a result of the global coronavirus pandemic, which prompt Goldman to slash 2% from its global Q1 GDP forecast, and JPM to predict that China’s economy has effectively frozen in the first quarter, it was only a matter of time before the Fed jumped on the bandwagon and used nCoV-2019 as the latest bogeyman giving Powell free reign to cut rates and/or launch QE5 (as a reminder QE4 which was launched to “fix” the repo market is set to wind down in Q2).

And sure enough, in the latest semi-annual Monetary Policy Report submitted to Congress, the Coronavirus indeed makes a triumphant appearance, with the Fed board warning that the coronavirus outbreak “presented a new risk” to the economic outlook for the U.S. and warned of disruptions in global markets.

Specifically, with “fragilities in the corporate and financial sector” leaving China vulnerable to adverse developments, “because of the size of the Chinese economy, significant distress in China could spill over to U.S. and global markets through a retrenchment of risk appetite, U.S. dollar appreciation, and declines in trade and commodity prices” the Fed warned, adding that “the effects of the coronavirus in China have presented a new risk to the outlook.”

In short: if a global virus pandemic is about to halt global growth, the Fed is confident it can fix it by just making money even cheaper and/or printing it outright.

Never one to miss a market downtick, the Fed also pointed out that “in recent weeks, equity and bond markets gave up some of their gains as uncertainty about the economic effects of the coronavirus weighed on investors’ sentiment.” It was not immediately clear if the Fed has hit “refresh” since last Friday, when stocks soared over 3% in the past week, rising to new all time highs as markets priced in precisely the likelihood that the Fed would step in and “fix” any stock selloff as a result of the world’s global pandemic in decades.

The report, which was published ahead of Powell’s Feb 11 biannual testimony before Congress in which he will discuss the economy and monetary policy before the House Financial Services Committee, and the Senate banking panel the following day, also noted that “asset valuations are elevated and have risen since July 2019, as investor risk appetite appears to have increased”, oblivious to the grotesque irony that it was the Fed’s own balance sheet expansion by half a trillion dollars that sparked this asset “elevation”, and which shows no signs of slowing down. As a reminder, overnight SMBC Nikko explained just how the Fed’s balance sheet expansion is elevating stock prices: we urge Powell and all members of Congress to read the post.

In addition to noting “elevated asset valuations”, which as we showed recently as the highest since the dot com bubble..

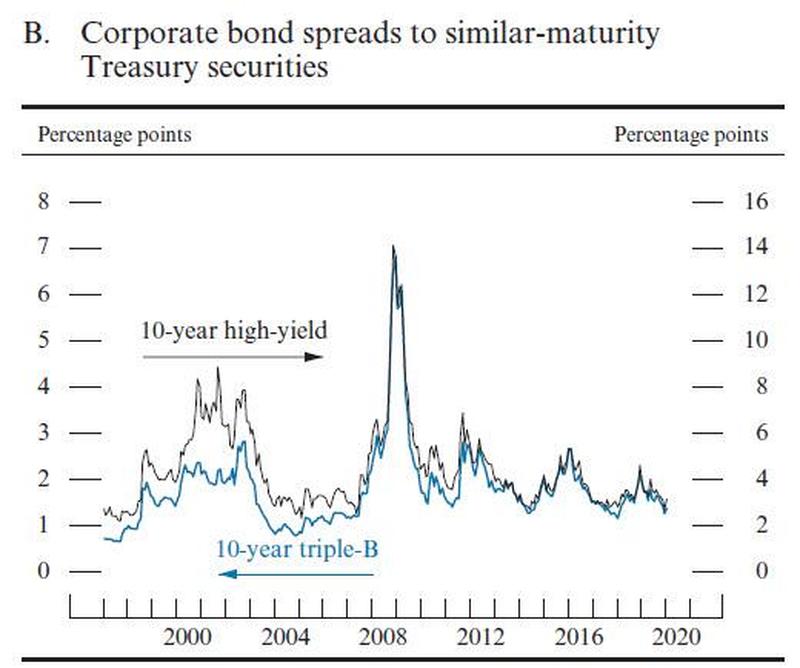

… a section on financial stability was more descriptive than the previous report on possible points of stress. The Fed said that low interest rates had elevated asset valuations, and it also pointed to risks in the corporate debt markets. Specifically, the Fed has now joined the fallen angel downgrade warning, stating that “the concentration of investment-grade debt at the lower end of the investment-grade spectrum creates the risk that adverse developments, such as a deterioration in economic activity, could lead to a sizable volume of bond downgrades to speculative-grade ratings. Such conditions could trigger investors to sell the downgraded bonds rapidly, increasing market illiquidity and causing outsized downward price pressures.”

Of course, the Fed also discussed the Repocalypse – the event that triggered not only the hundreds of billions in liquidity injections via repo, but also QE4 – noting that volatility in repurchase agreement markets in September “highlighted the possibility for frictions in repo markets to spill over to other markets.”

Finally, the report also dedicated a section focusing on the slowdown of manufacturing in the U.S. in 2019. The Fed attributed the decline to a range of issues including international trade tensions, weak global growth, softer business investment, lower oil prices affecting drillers and the slowdown in production of Boeing Co.’s 737 Max airliner, to wit:

The slump in manufacturing last year is attributable to several factors, including trade developments, weak global growth, softer business investment, lower oil prices engendering a cutback in demand by drillers, and the slower production of Boeing’s 737 Max aircraft due to safety issues

Ominously, the Fed also said that when considering the implications of these declines in manufacturing production for the broader economy, “it is important to recognize that this weakness has likely spilled over to other sectors.”

Which is code for “even more money printing is guaranteed”. The only question is if it comes before or after negative rates.

The Rest…HERE