The $6 Trillion Pension Bailout Is Coming

by Lance Roberts via RealInvestmentAdvice.com,

ZeroHedge.com

Thu, 07/25/2019

Fiscal responsibility is dead.

This past week, Trump announced he had reached an agreement with Congress to pass a continuing resolution which will suspend the debt ceiling until July 2021.

The good news is that it will ONLY increase spending by just $320 billion.

What a bargain, right?

It’s a lie.

That is just the “starting point” of proposed spending. Without a “debt ceiling” to constrain spending, the actual spending will be substantially higher.

However, the $320 billion is also deceiving because that is on top of the spending we have already committed. As I noted just recently:

“In 2018, the Federal Government spent $4.48 Trillion, which was equivalent to 22% of the nation’s entire nominal GDP. Of that total spending, ONLY $3.5 Trillion was financed by Federal revenues, and $986 billion was financed through debt.

In other words, if 75% of all expenditures is social welfare and interest on the debt, those payments required $3.36 Trillion of the $3.5 Trillion (or 96%) of revenue coming in.”

Do some math here.

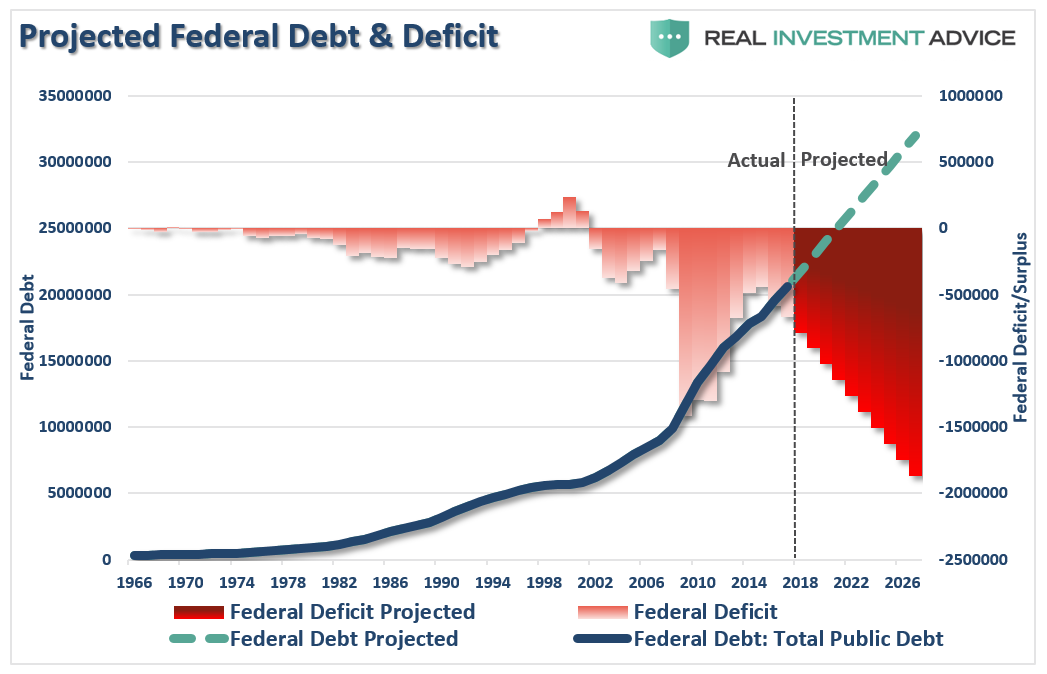

The U.S. spent $986 billion more than it received in revenue in 2018, which is the overall “deficit.” If you just add the $320 billion to that number you are now running a $1.3 Trillion deficit.

Sure enough, this is precisely where I forecast we would be in December of 2017.

“Of course, the real question is how are you going to ‘pay for it?’ On the ‘fiscal’ side of the tax reform bill, without achieving accelerated rates of economic growth – ‘the debt will balloon.’

The reality, of course, is that is what will happen because there is absolutely NO historical evidence that cutting taxes, without offsetting cuts to spending, leads to stronger economic growth.”

More spending, less revenue, equals bigger deficits, which equates to slower economic growth.

“Increases in the national debt have long been squandered on increases in social welfare programs, and ultimately higher debt service, which has an effective negative return on investment. Therefore, the larger the balance of debt becomes, the more economically destructive it is by diverting an ever growing amount of dollars away from productive investments to service payments.

The relevance of debt versus economic growth is all too evident, as shown below. Since 1980, the overall increase in debt has surged to levels that currently usurp the entirety of economic growth. With economic growth rates now at the lowest levels on record, the growth in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare.”

The Rest…HERE