Meat Exports To China Soar As US Supplies Dwindle & Workers Risk COVID-19 Infection

by Tyler Durden

ZeroHedge.com

Mon, 05/11/2020

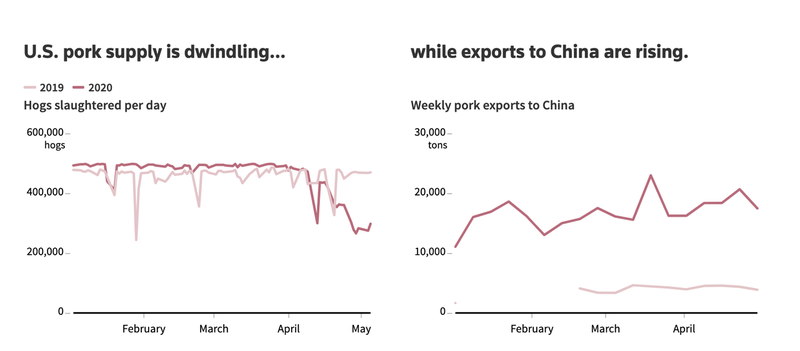

As wholesale beef prices exploded to record highs and President Trump ordered workers at meatpacking plants around the US to get back to work after COVID-19 outbreaks prompted ~1/3rd of them to close (as we explained at the time, meatpacking plants are veritable breeding grounds for SARS-CoV-2), the plants that were still on-line continued to churn to try and prevent the US “food-supply chain from breaking”. However, rather than doing their patriotic duty, a Reuters investigation has found that these plants have been increasingly exporting to China since the crisis began.

Of course, this shouldn’t surprise experienced analysts who have been watching China for years. Since President Xi’s rise to power, China has been taking steps to secure a growing share of American pork and other meats. Analysts warned at the time that this could create serious problems for the US food supply as China turns America’s own ‘hyper-capitalist’ system against it.

China promised to increase purchases of U.S. farm goods by at least $12.5 billion in 2020 and $19.5 billion in 2021, over the 2017 level of $24 billion. Since Jan. 1, ~31% of American pork produced has been exported, totaling about 838,000 tons, according to data from the US Meat Export Federation. 1/3rd of that went to China, accounting for more than 10% of total Q1 production, according to the MEF.

What’s more, the growing exports are actually a good thing, in a sense, since it means Beijing is technically taking steps to abide by its agreement to buy more than $200 billion in additional American goods over two years – though China has mostly limited its purchases to goods that benefit China (often these involve purchases of ag or energy commodities). But as reports published in the Chinese press on Monday raised new doubts about the viability of the US-China trade deal, it suddenly appears that perhaps President Trump has finally realized that his ‘largely-for-show’ trade deal is no longer the PR win he once believed it to be, now that ~70% of Americans are now suspicious of China.

“We know that over time exports are critically important. I think we need to focus on meeting domestic demand at this point,” said Mike Naig, the agriculture secretary in the top U.S. pork-producing state of Iowa who supported Trump’s order.

And now, it looks like that’s exactly what’s happening, as data cited by Reuters have shown:

Processors including Smithfield Foods, owned by China’s WH Group Ltd, Brazilian-owned JBS USA [JBS.UL] and Tyson Foods Inc temporarily closed about 20 U.S. meat plants as the virus infected thousands of employees, prompting meatpackers and grocers to warn of shortages. Some plants have resumed limited operations as workers afraid of getting sick stay home.

The disruptions mean consumers could see 30% less meat in supermarkets by the end of May, at prices 20% higher than last year, according to Will Sawyer, lead economist at agricultural lender CoBank.

While pork supplies tightened as the number of pigs slaughtered each day plunged by about 40% since mid-March, shipments of American pork to China more than quadrupled over the same period, according to U.S. Department of Agriculture data.

Smithfield, which China’s WH Group bought for $4.7 billion in 2013, was the biggest U.S. exporter to China from January to March, according to Panjiva, a division of S&P Global Market Intelligence. Smithfield shipped at least 13,680 tonnes by sea in March, Panjiva said, citing its most recent data.

Smithfield, the world’s biggest pork processor, said in April that U.S. plant closures were pushing retailers “perilously close to the edge” on supplies.

The company is now retooling its namesake pork plant in Smithfield, Virginia, to supply fresh pork, bacon and ham to more U.S. consumers, according to a statement. The move is an about-face after the company reconfigured the plant last year to process hog carcasses for the Chinese market, employees, local officials and industry sources told Reuters.

Of course, the owners of slaughterhouses have opposed the president’s order, claiming forcing workers back into the plants could result in unnecessary sickness and death. Of course, the falling supplies they’ve warned about could potentially benefit the bottom lines of these companies. Remember, Smithfield Foods is the biggest pork producer in the world.

Source: Reuters

On top of the coronavirus crisis, China has been struggling with a brutal outbreak of African swine fever, which wiped out roughly one-third of the country’s live hogs last year, forcing China to ratchet up imports (one reason why striking the ‘Phase 1’ deal was politically advantageous for President Xi).