“There’s No Gold” – COMEX Report Exposes Conditions Behind Physical Crunch

by Tyler Durden

ZeroHedge.com

Sat, 03/28/2020

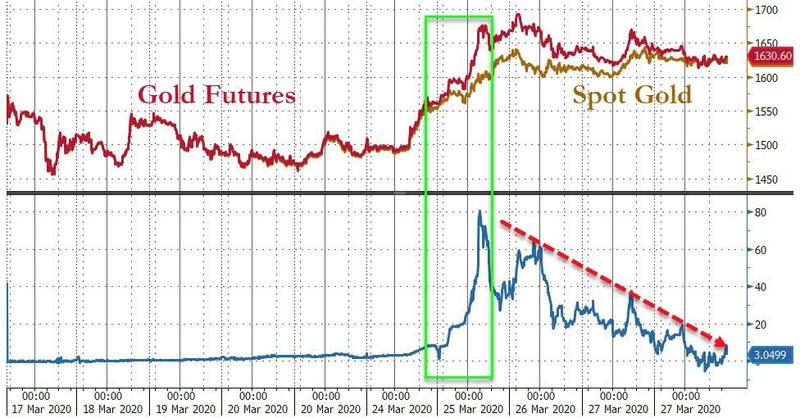

Early this week, we were among the first to report on the “break down” in precious metals markets.

While the demand for gold has been soaring as a safe haven asset amid the multiple global crises we are currently facing, forced paper gold liquidation (as leveraged funds scramble to cover margin calls) and unprecedented logistical disruptions created a frantic hunt for actual bars of gold.

Specifically, as Bloomberg details, at the center of it all are a small band of traders who for years had cashed in on what had always been a sure-fire bet: shorting gold futures in New York against being long physical gold in London. Usually, they’d ride the trade out till the end of the contract when they’d have a couple of options to get out without marking much, if any, loss.

It’s at this point that things get really bad for the short-sellers.

To make good on maturing contracts, they’d have to move actual gold from various locations. But with the virus shutting down air travel across the globe, procuring a flight to transport the metal became nearly impossible.

If they somehow managed to get a flight, there was another major problem. Futures contracts in New York are based on 100-ounce bullion bars. The gold that’s rushed in from abroad is almost always a different size.

The short-seller needs to pay a refiner to re-melt the gold and re-pour it into the required bar shape in order for it to be delivered to the contract buyer. But once again, the virus intervenes: Several refiners, including three of the world’s biggest in Switzerland, have shut down operations.

“I realized it was going to be an extremely volatile day,” Tai Wong, the head of metals derivatives trading at BMO Capital Markets in New York, said of Tuesday. “We watched this panic develop literally over the course of 12 hours. Having seen enough market dislocations, you recognize that the frenzy wasn’t likely to last, but at the same time you also don’t know how long it would extend.”

By the end of the week, the shorts had sourced the metal and chartered flights, reverting the spot-futures spread…

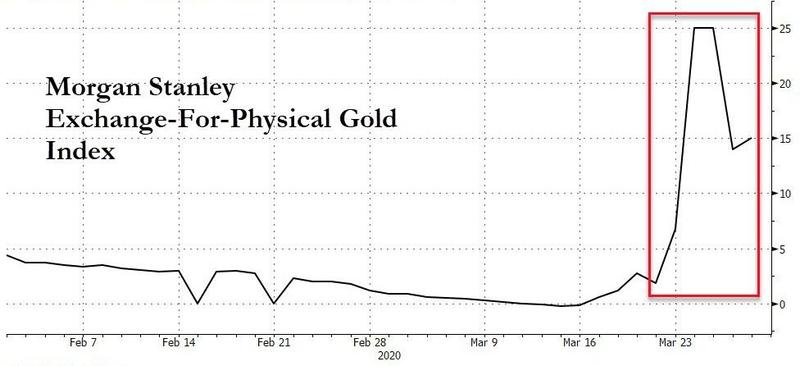

But Morgan Stanley’s Exchange-For-Physical Index shows a large physical premium remains…

The real price.. for real gold? Nearer $1,800. If you can get it.

“There’s no gold,” says Josh Strauss, partner at money manager Pekin Hardy Strauss in Chicago (and a bullion fan).

“There’s no gold. There’s roughly a 10% premium to purchase physical gold for delivery. Usually it’s like 2%. I can buy a one ounce American Eagle for $1,800,” said Josh Strauss. “$1,800!”

“The case for gold is simple,” says Strauss.

“You want to own gold in times of financial dislocation and or inflation. And that’s been the case since time immemorial. And gold behaves well in those cases. In those cases stocks behave poorly. It’s a great portfolio hedge. Gold does poorly when you’ve got strong economic growth and low inflation. Tell me when that’s going to happen. Gold held its value during 2008 and after all that money printing it tripled over the next three years.”

And in case you doubted this, the cost of an American Eagle one ounce coin at the US Mint is now $2,175…

The Rest…HERE