Fed Chair Powell Issues Statement To Calm Crashing Markets, Fails

by Tyler Durden

ZeroHedge.com

Fri, 02/28/2020

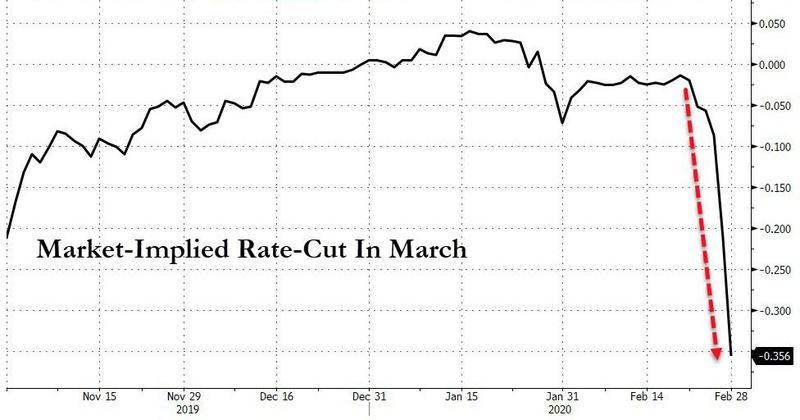

With stocks crashing, yields plunging, supply-chains fraying, China’s economy freezing, junk bonds tumbling, credit and equity markets grinding to a halt, and the global economy on the verge of a crisis the likes of which it has not seen since Lehman, moments after both Goldman and Bank of America predicted the Fed would cut rates as soon as next month (and in the case of BofA, an emergency double cut could come any moment), in a shocking, rare admission that the Fed is “on top of thing”, Fed Chair Powell, aware that everyone was looking at the Fed for guidance on what happens next and whether it will conduct an emergency Sunday night global intervention in markets, at exactly 2:30pm on Friday with 90 minutes left until the close, Powell issued an unprecedented statement meant to do just one thing: calm markets and stop the selloff.

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.

While Powell admitted what everyone knows, namely that the coronavirus “poses evolving risks” to U.S. growth and signaled the central bank is prepared to cut interest rates if necessary to support the expansion, what nobody still knows yet, is whether the current state of events is enough for the Fed to rush with a 25-50bps emergency rate cut as soon as Sunday.

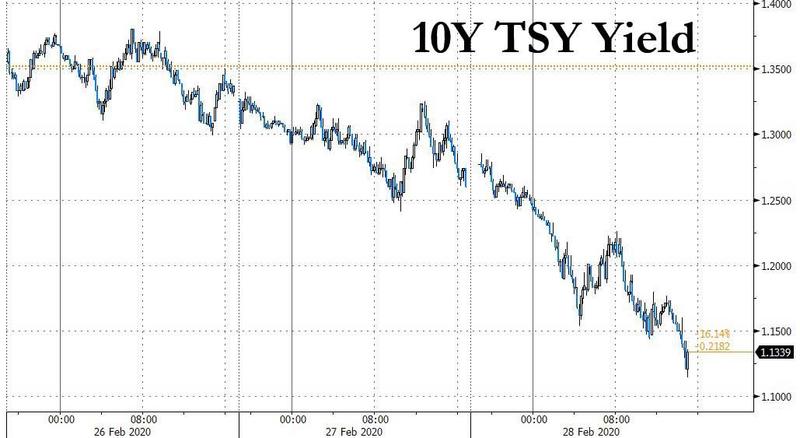

Powell’s statement, which was posted on the Fed’s website 90 minutes before markets closed for the weekend comes as stocks were in their seventh-straight loss, prompting calls multiple rate cuts by Wall Street banks, and as markets expect more than 1 rate cut in March…

… yields on U.S. Treasuries are plunging to record lows.

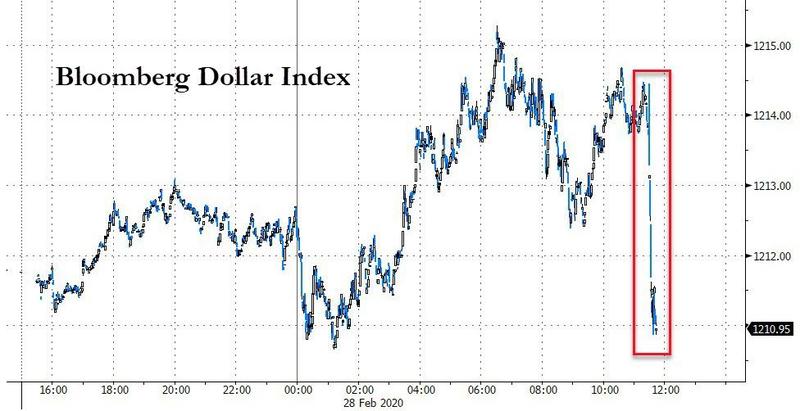

While stocks may have been expecting a far more forceful statement from Powell, they took the rare communication from Powell in stride, and after spiking higher, then grinding lower upon realizing that Powell did not really commit to anything, stocks have continued to rise…

… with the dollar plunging…

… as traders are now indicating that this is a preview of what now appears an almost certain Sunday night central bank intervention, whether standalone or coordinated with other global central banks.

And yet, as we warned earlier, a Sunday emergency rate cut could be the worst possible outcome. As we noted earlier in our “Sunday night action” preview post, the danger is that after a coordinated central bank response, investors will be forced into chasing a move higher in equities out of fear that they “missed the lows,” but into that inevitable “cluster” report of confirmed cases in a global mega-city outside of China (see what’s happening in California now as prime target), “as the pandemic is now certainly “real”—which could drive another shock-down, but this time, without the hedges which, on the way down, can also act as “insulation” when monetized.”

In other words, if or rather when the corona pandemic gets even worse after central banks have fired their collective bazooka, the market’s response will be far more adverse as central banks will have staked their credibility on being able to offset the economic consequences of the pandemic (they can’t, unless they can print viral antibodies), while investors will now be looking into the abyss without any hedges left.

And that would be catastrophic…. which may also explain why after briefly spiking, stocks have given up all modest gains, and are once again sliding while the 10Y yield is tumbling to new all time lows, at one point just 11bps above 1.00% in a move that screams either recession or, more likely, depression.