Stockman Warns “The Jig Is Up!” – Covid-19 And The Defenestration Of The Central Bankers

by David Stockman via Contra Corner blog,

ZeroHedge.com

Wed, 02/26/2020

Let it be said that historians will surely marvel – and at some point soon – about the grand delusion of the present era. Namely, the near universal belief that central bankers could print, peg and palaver the main street economy into unfailing expansion and ever rising prosperity and that there were essentially no macro-risks to soaring stock prices that their toolkits couldn’t contain and counteract.

That misbegotten belief had huge untoward consequences. It made economies brittle with too much leverage, financialization and speculation; and fragile with too few shock absorbers and insurance mechanism such as just-in-case inventories, second suppliers and local sources for physical production and back-up liquidity lines and balance sheet reserves for financial operations.

Then came the Black Bat of 2020 (or whatever) with its toxic economic contagion. Racing with virtually lightening speed through an infinitely complex and deeply integrated global supply chain anchored in the Red Ponzi, the breakdown of economic activity is already proving that the central banks are not omnipotent after all.

Just as they cannot print antibodies to stop the coronavirus disease, they can’t print raw materials, intermediates, components and sub-assembly to restart broken supply chains. Super-QE wouldn’t do it; double digit subzero rates wouldn’t help; and openmouth forward guidance would only call to mind King Canute shouting at the incoming sea.

It is too early to tell, of course, as to whether the Covid-19 is the Big Bang or if it will be soon wrestled to ground by public health authorities around the planet, thereby eventually relieving the global supply chains of quarantined workers, grounded planes, ships and trains, depleted inventories and paralyzed business decision processes.

But even assuming the latter, the predicate of central bank omnipotence should now be swept into the dustpan of history. Not only can the Fed not repair and revive disrupted supply chains, but it can’t even accomplish the conventional tasks it has defined for itself. Namely, making domestic inflation rise by 2.00% annually and causing output growth to adhere unfailingly to the path of full-employment GDP, world without end.

That’s because in a world of Peak Debt—-$255 trillion globally and $74 trillion in the U.S. alone—the Fed’s policy tools are not only impotent; they are actually malignant.

It is now more than evident that the impact of massive bond-buying/balance sheet expansion (QE) and brutal repression of money market interest rates never goes beyond the canyons of Wall Street. It just inflates, inflates and inflates further the price of financial assets owing to the symbiotic confluence of carry trade speculators on Wall Street and the huge financial engineering joints that have been fostered in the C-suites of corporate America by central bankers.

As a consequence, capital has been artificially drafted into financial speculation and money dealing. At the same time, household and business balance sheets have been deeply impaired in order to live high on the hog today rather than investing for the long haul and positioning to weather the unpredictable vicissitudes of individual and collective life–illness, accidents, wars, pestilence, droughts and plagues, one of which we are now experiencing.

But virtually none of that vaunted “stimulus” makes its way to main street. Neither output, employment nor inflation is materially impacted by the Fed’s incessant interventions and machinations in the financial markets.

Take the objective of 2.00% inflation targeting that Fed head Lael Brainard was yapping about last week. In the first place we wonder exactly why she’s complaining about persistent inflation shortfalls from target and therefore the need for even more “monetary accommodation” in order to cause inflation to run hotter until it averages 2.00% over a permanent time frame.

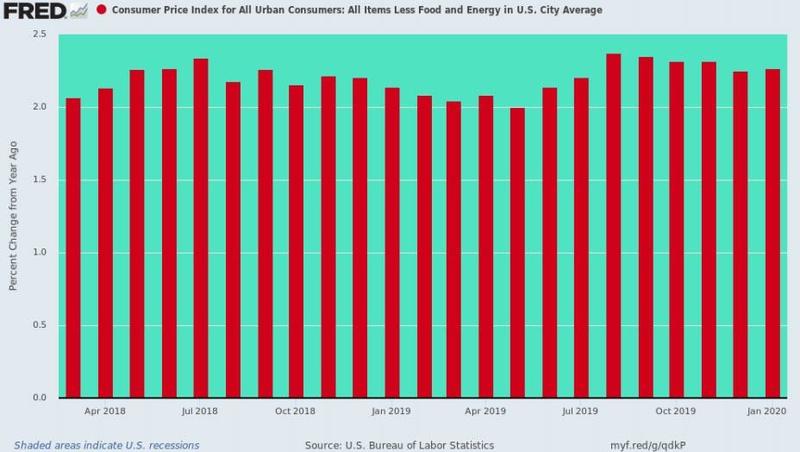

The fact is, the CPI less its volatile food and energy components has exceeded 2.00% for 23 months running. How is that a shortfall?

Indeed, we don’t need a magnifying glass to grasp the story in this case. There is nary a single bar below the sacred 2.00% line in the entire 23 month-long chart below.

CPI Less Food And Energy, Year-Over-Year Change Since March 2018

The Rest…HERE