Dash-For-Cash Ahead Of The Next Market Crash: Ultra Rich Prepare For Economic Storm

by Tyler Durden

ZeroHedge.com

Tue, 09/24/2019

We have described, in the last several days, a fascinating trend that is developing: the dash for cash ahead of the next market crash.

The Bank for International Settlements (BIS) warned over the weekend about an imminent financial crisis, while it was reported on Monday that billionaire hedge fund manager Paul Singer is building cash to take advantage of opportunities after the next crisis. On Tuesday morning, we noted how 200 institutions that manage a combined $4.1 trillion in assets, are becoming increasingly bearish ahead of 2020. Now Bloomberg is reporting that family offices around the world are stockpiling cash ahead of a market meltdown.

Bloomberg spoke with Rick Stone, a former partner at Cadwalader, Wickersham & Taft, who sees economic storm clouds ahead, if not already here.

Stone warned about low bond market returns over the next decade. He said equity markets would crash and then go flat, and said venture capital and private equity money would continue the hunt for yield in very few opportunities.

Stone currently runs the Palm Beach Investment Research Group, a network of 35 family offices in Palm Beach, Florida. “The areas to invest in are fewer, and there is a lot of money looking for those spaces,” he said.

The bearish macro view shared by the family offices in South Florida is also shared by 360 global single- and multi-family offices surveyed in the 2019 UBS Global Family Office Report, which was conducted in conjunction with Campden Research and published Monday, Bloomberg said.

The survey said most family offices expect the global economy to tumble into a recession by 2020, with the most doom and gloom in emerging markets. About 42% of family offices around the world were quickly building cash by late summer ahead of an economic downturn.

“There’s more caution and fear of the public equity markets among ultra-high-net-worth investors,” said Timothy O’Hara, president of Rockefeller Global Family Office. “That has more people thinking about private investments, alternative investments or cash.”

Campden said the family offices in the UBS survey had $917 million under management. The survey was conducted between February and March.

Most offices had 5.4% returns over the 12 months before taking the survey, with disappointing returns in developed markets (2.1%) and significant returns in Asia-Pacific and emerging markets regions (6.2%). North America yielded 5.9% returns, and Europe was 4.3%.

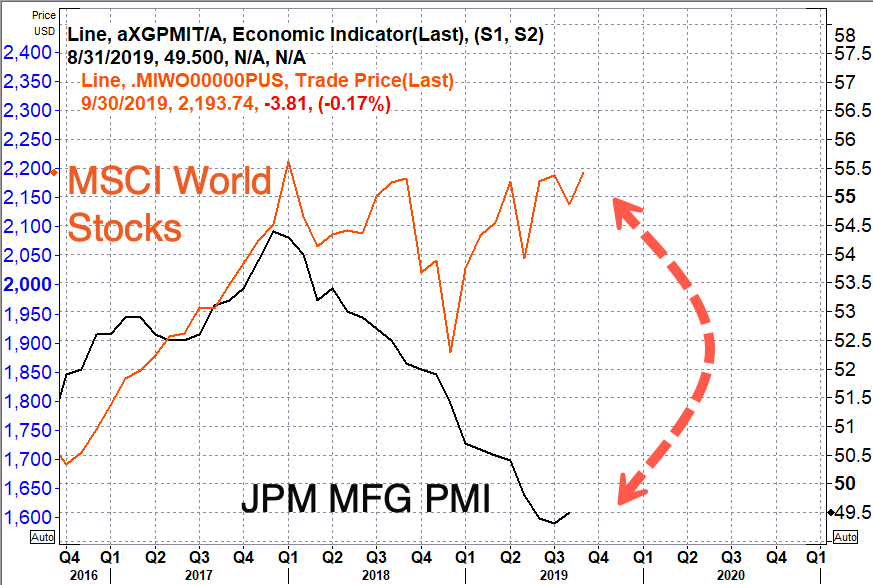

And we wonder why family offices around the world are building cash? Maybe because the twilight period of global equities is coming to an end, and a growth scare could be imminent (remember fall of 2018?).