Active Asset Managers Are Facing A $74 Trillion Problem…”We’re clearly at a watershed moment…”

by Tyler Durden

ZeroHedge.com

Fri, 08/09/2019

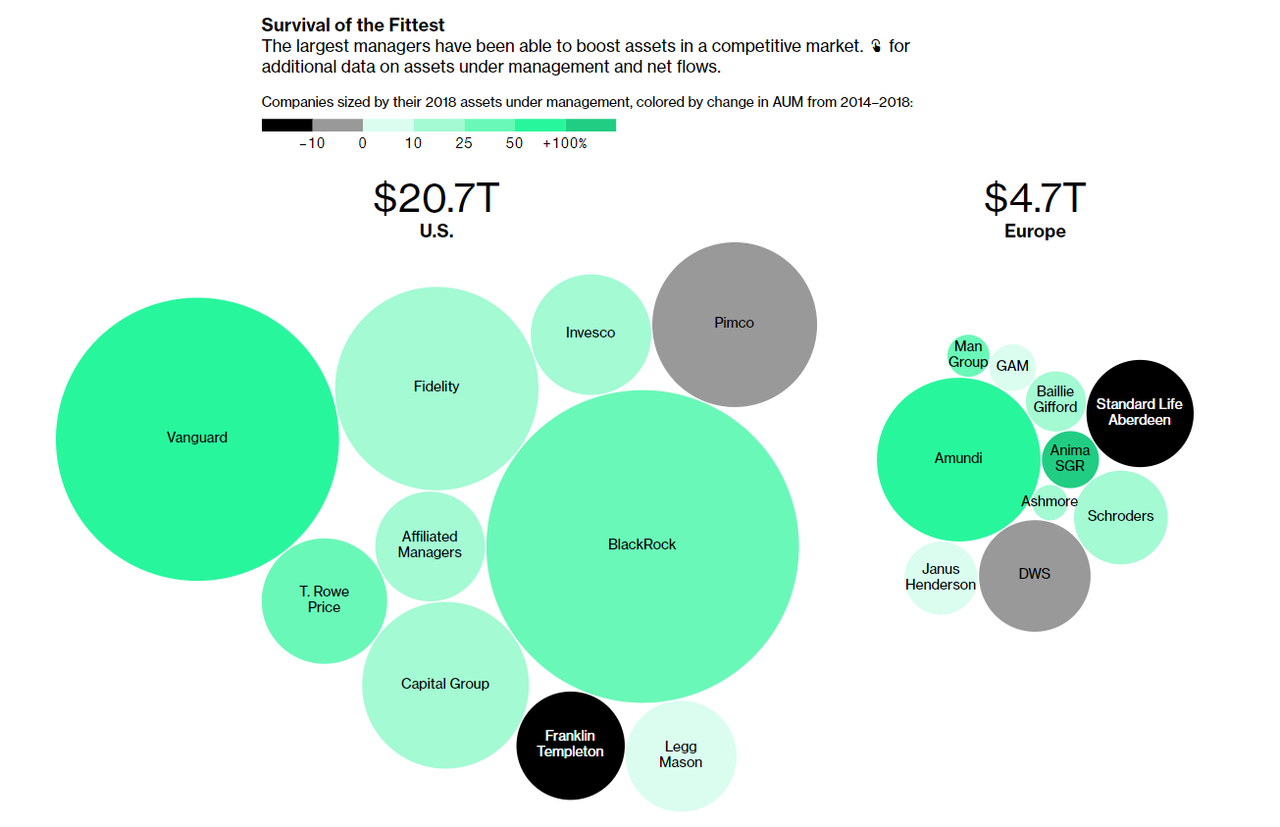

Active asset managers are on the precipice of a $74 trillion problem, according to Bloomberg. Every day investors that have been frustrated by poor returns and higher fees are shifting their money out of actively managed funds and into passively managed funds, as we have documented on this site for sometime.

As we have noted, this has sent fees much lower, while forcing active managers to make job cuts. This means that the $74 trillion industry is on the verge of what will likely be a historic shakedown where only the best managers will survive.

Philip Darling, head of partnerships at The Buy-Side Club said: “We’re clearly at a watershed moment”.

The analysis looked at fees, personnel and performance data across the industry and revealed how difficult the environment has truly become.

Ben Phillips, principal and investment management chief strategist at consulting firm Casey Quirk said:

“The combination of fee competition, rising costs and asset growth is creating never-before-seen pressures on asset managers. That creates a really bitter cocktail for an industry that never had to worry about fixed costs, fees or money showing up. The entire industry has been caught flat-footed. Nobody saw it coming. That sounds a little glib, but nobody acted to get around the corner first.”

Investors have done nothing but make a beeline into passive investments in recent years. Index funds are going to overtake active management by the year 2021, according to estimates issued in March by Moody’s Investors Service.

The Rest…HERE