Nomura: We Are Headed For A Second “Lehman-Like Shock” Selloff

by Tyler Durden

ZeroHedge.com

Tue, 08/06/2019

Last week, in the aftermath of the Fed’s “mid-cycle” rate cut which sparked a tantrum in the market demanding the start of an easing cycle (which Trump appeared to deliver when he announced an escalation in the trade war with China which resulted in a devaluation in the yuan below 7.00 just days later), Nomura’s quant team cautioned that as a result of surging economic uncertainty, it anticipated the loss of the “buying support it has been getting from macro-oriented funds and longer-term investors” and the result would be systematic selling pressure which “could gain the upper hand for a while.”

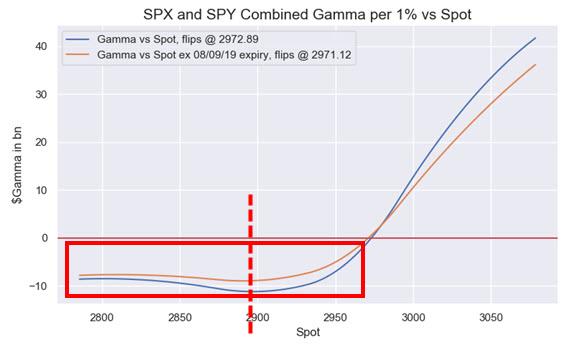

This, as Charlie McElligott detailed, is precisely what happened on Monday when the S&P dipped below key CTA selling thresholds, as we discussed yesterday in “Here Comes The “Extreme Negative Gamma” Selling Avalanche” which materialized almost instantly, sending the S&P on its biggest daily drop of 2019:

Another reason why Nomura’s quants were worried was simpler: the calendar, i.e., August is a month where liquidity is especially thin as traders are on vacation, and the result tends to be a “volatility shock.”

And most remarakble was Nomura short-term forecast, according to which the Japanese bank saw “the S&P 500 being taken down into the 2,850-2,900 range.”

Just a few days later that’s precisely what happened.

The Rest…HERE