Mish: Gold Gains As Faith In Central Banks Is About To Be Tested Again

by Mike Shedlock via MishTalk,

ZeroHedge.com

Wed, 06/05/2019

Gold put in a strong performance with the St. Louis Fed president presenting a case for cutting rates.

St. Louis Fed president James Bullard helped light a fire under gold today, Yapping About Too Little Inflation and the Need for Rate Cuts.

Technically speaking, the $1350 to $1370 area has been one tough nut for gold to crack.

On a weekly chart, gold has failed in this area five or six times, depending on how one counts.

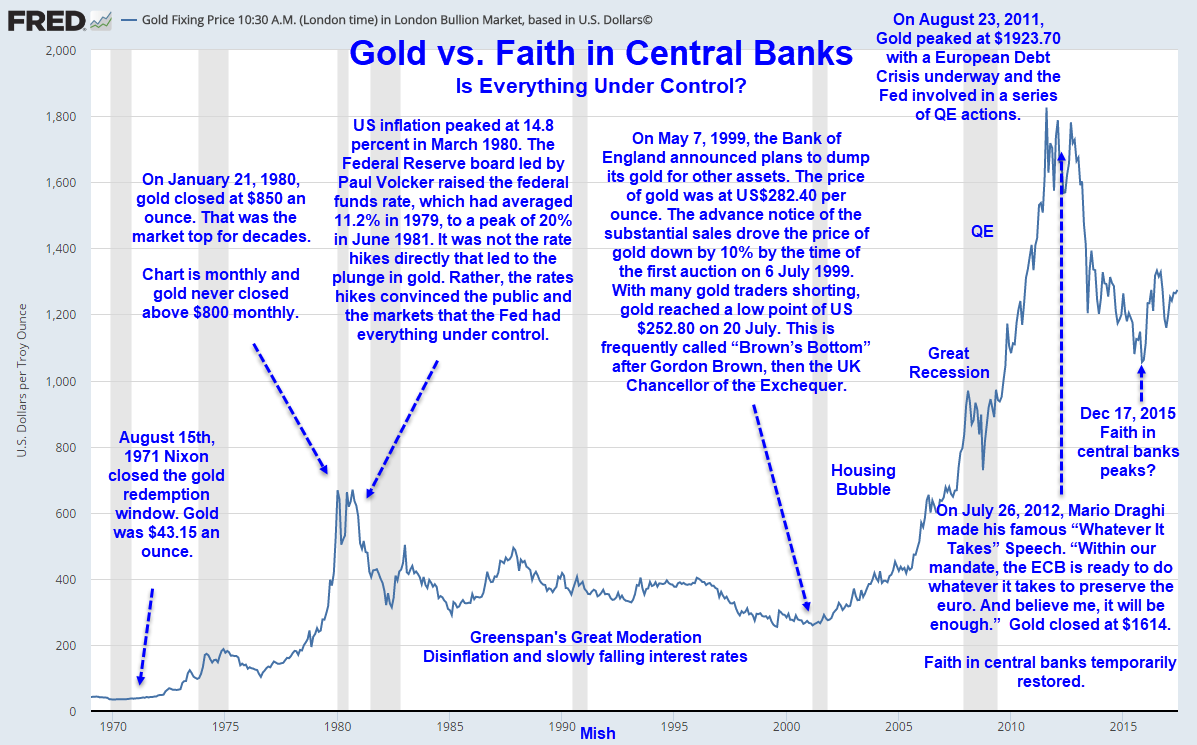

Gold a Hedge, But Against What?

Some view gold as an inflation hedge.

It isn’t.

Gold is a hedge against the notion that the Fed has things under control.

Gold fell from $850 an ounce in 1980 to $262 an ounce in in 1999 with inflation every step of the way.

People believed Greenspan, the great “maestro” had everything under control. It was an illusion.

Faith in central banks is about to be tested again.